Navigating Choppy Waters

May 19, 2023

We’re just past this year’s spring Q2 midpoint, and it’s been a choppy rebound since late Q4 2022 when we hit the bottom of this last real estate cycle--at least in NYC. Since mid January, we’ve been in recovery mode and have managed relatively well despite the headwinds of rising mortgage interest rates, banking industry shakeups, and the current looming talk of the US debt ceiling obligations.

In New York, we’re back to pre-pandemic levels, having regained the acknowledged 8-12% drop in property pricing from 3 years ago. To recap:

2020 was a pandemic year, dominated mostly by fears of Covid and hopes for a vaccine that finally came in November. According to Donna Olshan’s weekly report on properties priced at $4M and above, only 645 luxury contracts were signed in all of 2020. On top of that, we lost record breaking numbers of city dwellers who fled to surrounding Westchester and the Hamptons and states like Florida and Texas.

2021 saw a market rebound fueled by mortgage interest rates as low as 2.65% and high stock market gains; Olshan recorded an astonishing 1,877 signed contracts, shattering records going back to 2006 when she first started tracking luxury sales.

2022 started strong but soon weakened, achieving 836 luxury signed contracts during the first six months, according to Olshan’s report, with the second half of the year totaling only 468 signed contracts.

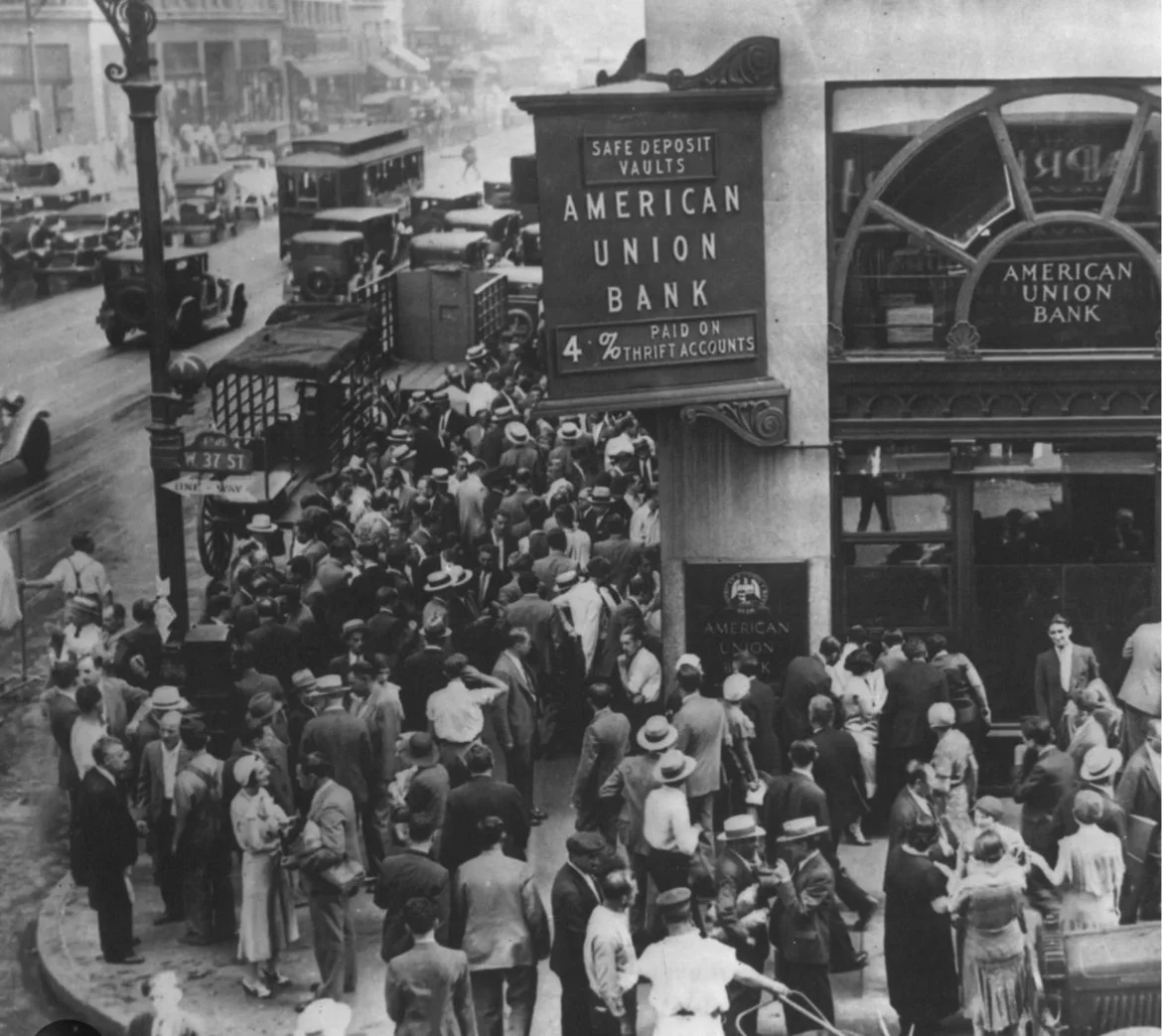

This year, we’ve managed to avert disasters, but it was a helluva roller coaster ride with stunning bank failures: first Silicon Valley Bank on March 10th followed by Signature Bank two days later; then UBS came to Credit Suisse’s rescue on March 19th, and JP Morgan Chase saved First Republic Bank with a purchase on May 1st. For sure, there is continued stock market turbulence, and struggles among regional banks. We’ll probably see more financial tightening everywhere, starting with lenders who will be more restrictive with extending credit, and corporations who will continue with layoffs to show scant profitability, and even with our individual purses that continue to be stretched by persistent inflation.

“This year, we’ve managed to avert disasters, but it was a helluva roller coaster ride.”

On the housing front, unless you’re a cash buyer, you may have stepped to the sidelines about a year ago when the Fed began raising mortgage interest rates on eight separate, successive occasions. Our banker friends tell us they are sending out more and more preapproval letters today, but they also admit not all would-be purchasers are actually moving to real loan commitments. Nonetheless large numbers of buyers have acclimated to the new normal of higher rates that are hovering in the mid 6% range. The average rate on the 30-year fixed-rate product is more than twice what it was two years ago but less than the 7% high late last year.

This gradual acceptance of still historically low mortgage rates is contributing to our market’s recovery this year. Contract signed activity has shown substantial increases, building momentum slowly but steadily each month from a low of 65 luxury contracts signed in January to a high of 40 signed contracts last week, which was the largest weekly total this year.

So is now the time to buy or sell? The answer depends on your personal situation. We know that real estate is cyclical, but trying to time the market—to sell high and buy low—can be paralyzing, wastes precious time and causes you to miss opportunities. Rarely have I heard anyone say they regretted making a purchase. More commonly, I’ve heard many say they were sorry they didn’t take action. The advice to buyers is don’t hesitate. If you see the right property fit, go for it. Although inventory is rising slightly, the stock of quality apartments remains tight in many market sectors, since homeowners with low interest rate loans are reluctant to give them up. In some segments where inventory is especially slim, like most of Brooklyn, there’s intense competition.

Today’s transactions are driven mostly by need, motivated by the life stages of birth, marriage, death and employment. For the immediate user, the current market offers significant opportunities. Co-ops are undervalued, and the Upper East Side and the Financial District are among the best value plays. If you’re buying and also selling at the same time, it’s important to do both in the same market. First time buyers are cautioned to look beyond the necessary down payment funds and also have enough in reserve to cover emergencies and also satisfy post closing co-op liquidity requirements. For sellers, less yields more with respect to pricing. The advice to sellers is to take advantage of an active spring, which is actually longer than the fall season. Now is the time to reevaluate your asking price to find your buyer, before an expected seasonal summer slowdown. This year, in particular, if you're not ready to come to market by June, it might be better to wait until the selling season ramps up again after Labor Day to ensure smooth sailing ahead. All aboard!